Table of contents

Caring for pets professionally is deeply rewarding, but it also comes with a unique mix of responsibility, unpredictability, and risk. Whether walking dogs, grooming, boarding, or providing daycare, pet care professionals work in environments where small moments can quickly turn into incidents.

By looking closely at our pet care claims data from 2025, clear and valuable patterns begin to emerge. These insights help us understand not only what incidents occur most often, but which ones tend to result in higher costs — and where practical changes can make the biggest difference.

This article shares those insights in a clear, supportive way, with the aim of helping pet care professionals reduce risk, protect themselves, and continue delivering great care.

A snapshot of claim severity in 2025

While many claims sit at a relatively modest level, a smaller number of more serious incidents, often involving surgery, long recovery times, or loss of earnings, see claims payouts in the thousands, highlighting a the significant cost of claims that can have a major financial impact when they occur.

Get Pet Business Insurance from Protectivity

The most common types of incidents

When incidents are grouped by type, five categories account for the vast majority of claims:

| Incident Type | Approx. Share |

| Dog injury during walk or play | 40% |

| Grooming-related injury | 30% |

| Dog-on-dog aggression | 15% |

| Policyholder injury or personal accident | 10% |

| Illness, ingestion, heat or environmental factors | 5% |

Together, these categories reflect the everyday realities of professional pet care — walking, handling, grooming, and managing dogs in shared spaces.

Which incidents tend to cost the most?

While frequency matters, severity tells a deeper story. Some incident types occur less often but tend to result in significantly higher claims when they do happen.

Boarding, daycare, and transit incidents

Incidents occurring during boarding, daycare, or transit are among the most expensive on average. These situations often involve prolonged care or higher-risk environments, such as vehicles or shared indoor spaces. When something goes wrong in these settings, injuries can be more serious and treatment more complex, which naturally increases costs.

Transit-related incidents in particular highlight the importance of secure handling during loading, unloading, and travel. Even brief lapses in control can escalate quickly once a vehicle or road is involved.

Walk and play injuries

Injuries that occur during walks or free play are by far the most common and remain a major cost driver overall. These incidents typically involve falls, collisions, uneven terrain, or contact with environmental hazards such as sticks, glass, or dense undergrowth.

Although many walk-related injuries fall into a mid-range cost bracket, their sheer volume means they contribute significantly to total claims. Off-lead activity and challenging terrain tend to increase both frequency and severity, particularly for older dogs or certain breeds.

Heat and environmental risks

Incidents linked to heat, wildlife, or environmental exposure occur less frequently but often result in higher veterinary intervention. Heat-related illness, insect stings, and snake bites can deteriorate rapidly and require urgent treatment. These risks are highly seasonal, but their impact can be severe if not carefully managed.

Human injury and loss of earnings

Claims involving injury to the pet care professional themselves represent a meaningful portion of overall costs. Slips, trips, falls, being pulled over by dogs, or sustaining bites can lead not only to medical expenses but also time away from work. While many of these claims are moderate, those involving fractures or longer recovery periods can become particularly costly.

This category is an important reminder that risk management isn’t only about protecting pets — it’s also about safeguarding the people who care for them.

Grooming-related injuries

Grooming incidents are very common but usually less severe in financial terms. They often involve small cuts, nicks, or irritation that still require veterinary attention but typically resolve without prolonged treatment.

The frequency of grooming claims reflects how precise and delicate this work is. Dogs moving unexpectedly, sensitive areas such as ears and paws, and the use of sharp tools all increase the likelihood of minor injuries, even in experienced hands.

Seasonal trends: When claims increase

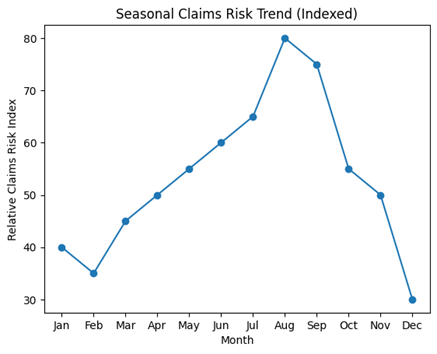

Claims tend to rise steadily through spring and peak in late summer.

The chart below shows an indexed view of seasonal claims risk across the year. Rather than reflecting claim volumes, it illustrates the relative level of risk, highlighting how incident likelihood builds gradually from spring, peaks in late summer, and then falls back toward winter.

Warmer weather, longer days, increased walking, and holiday routines all contribute to this seasonal uplift. Awareness of these patterns allows businesses to plan ahead and adjust practices during higher-risk periods.

What this means for Pet Care Professionals in 2025

The data points clearly toward a few practical, preventative themes.

Strong lead, harness, and transit procedures are essential, particularly when dogs are being moved in and out of vehicles. Simple checks and consistent routines can dramatically reduce the risk of high-cost incidents.

Heat and environmental awareness should be treated as a core safety issue, not an exception. Adjusting walk times, monitoring weather conditions, and being mindful of seasonal hazards can prevent serious outcomes.

Thoughtful route and activity selection matters. Off-lead play and challenging terrain should be balanced against the dog’s age, breed, and physical condition, with safer options used where appropriate.

In grooming environments, clear procedures, calm handling, and transparent communication with owners help manage expectations and reduce the likelihood of injury. Good documentation and aftercare guidance also play a valuable role.

Finally, protecting the wellbeing of pet care professionals themselves is critical. Managing group sizes, matching dogs carefully, and recognising early signs of risk can help reduce injuries and time away from work.

Closing thoughts

The 2025 claims data shows that most pet care incidents arise from everyday activities rather than unusual circumstances. Walks, grooming sessions, and routine handling account for the majority of claims — but the costliest incidents tend to occur when everyday moments escalate unexpectedly.

By understanding where incidents are most likely to happen, and which ones carry the greatest financial impact, pet care professionals can make informed, practical changes that improve safety for both pets and people.

Small adjustments, applied consistently, can make a meaningful difference — not just to claims outcomes, but to confidence, professionalism, and peace of mind across the industry.

Protect your pet clients with Pet Business Insurance

Whilst the risks are still relatively low for significant incidents that lead to higher financial losses, we’ve highlighted that however prepared or organised you are – unexpected things do happen.

Protectivity offer a comprehensive pet business insurance that can cover a wide range of pet care activities; dog walking, pet sitting, dog grooming, pet boarding and more.

The policy offers public liability with between £1 million and £10 million of cover and key cover up to £10,000 for new keys and locks, if you enter a client’s property to walk their dogs.

Also included is equipment cover, non-negligent cover, and a close family extension and our care, custody and control cover provides up to £100,000 worth of cover for animals in your care. For additional extras choose Employers’ Liability and commercial legal expenses.

Discover more and get your pet business quote online today!

Sources: Protectivity Claims data 1st Jan – 31st Dec 2025

*Disclaimer – This blog has been created as general information and should not be taken as advice. Make sure you have the correct level of insurance for your requirements and always review policy documentation. Information is factually accurate at the time of publishing but may have become out of date.

Last updated by