Table of contents

Table of contents

Table of contents

Contributors

My main focus is managing the blog and product content for the Protectivity website ensuring everything aligns wi...

When considering a career as an electrician, one of the popular questions is often about potential earnings. Understanding how much you can make in this trade is crucial for both aspiring electricians and those looking to start their own businesses.

In this blog, we’ll take a look at the various factors that influence an electrician’s salary, from entry-level positions to experienced roles and the potential earnings for self-employed professionals. We’ll also discuss additional income opportunities and financial management tips to help maximise your earnings.

Whether you’re just starting out or planning to expand your electrical business, knowing what to expect financially is key to making informed career decisions.

An Electricians’ role and responsibilities

An electrician’s role encompasses a variety of responsibilities depending on their specialisms. Broadly categorised into domestic, commercial, and industrial types, electricians tackle different scales and complexities of electrical work. Domestic electricians typically handle residential projects, including wiring homes, installing lighting fixtures, and ensuring household electrical systems are safe and up to code.

Commercial electricians work on larger projects such as office buildings, retail spaces, and other commercial establishments, focusing on installing and maintaining more complex electrical systems. Industrial electricians are found in factories and manufacturing plants, dealing with heavy machinery, control systems, and industrial-scale electrical systems. Key duties across these roles include reading and interpreting blueprints, installing and repairing wiring, troubleshooting electrical issues, and adhering to safety regulations.

Electricians with expertise in high-demand areas or advanced certifications often command higher salaries, reflecting their specialist skills and the critical nature of their work.

Entry-level earnings

Starting out as an electrician can be quite promising. For newly qualified electricians, the typical starting salary is around £24,000 to £32,000 per year, though this can vary. Several factors influence these entry-level earnings. Location plays a big role; electricians in urban areas or regions with a higher cost of living tend to earn more. The size of the company you work for can also impact your pay, with larger firms often offering better starting salaries.

The industry matters too; electricians working in specialised fields like renewable energy might start at a higher rate. Comparing apprenticeships to full-time entry positions, apprenticeships usually offer lower pay initially but provide invaluable hands-on experience and often lead to higher-paying jobs down the line.

Average earnings for experienced electricians

Once you’ve got a couple of years under your belt, your earnings can see a significant boost. Electricians with 2-5 years of experience typically earn between £36,000 and £52,000 annually. Additional qualifications and certifications can really bump up your salary; for instance, becoming a master electrician or gaining expertise in niche areas like automation systems can make you more valuable to employers.

Career progression examples include moving from a journeyman electrician to a supervisor role, which can offer even higher earnings. For instance, someone who starts as a domestic electrician might transition to a project manager role, overseeing large commercial projects with a salary well into the six figures.

Earnings for self-employed electricians

Going self-employed can be a game-changer for electricians. Potential income for self-employed electricians varies widely but can be quite lucrative. Many charge between £40 and £80 per hour, depending on their skills and the market demand. Project rates can be even higher, particularly for large-scale jobs. Your earnings will significantly depend on your business acumen and customer base.

Building a strong reputation and loyal clientele can lead to a steady stream of high-paying jobs. Essentially, the better you are at managing your business and marketing your services, the higher your potential earnings. Some self-employed electricians report making over £80,000 a year, thanks to their ability to take on multiple projects and set competitive rates.

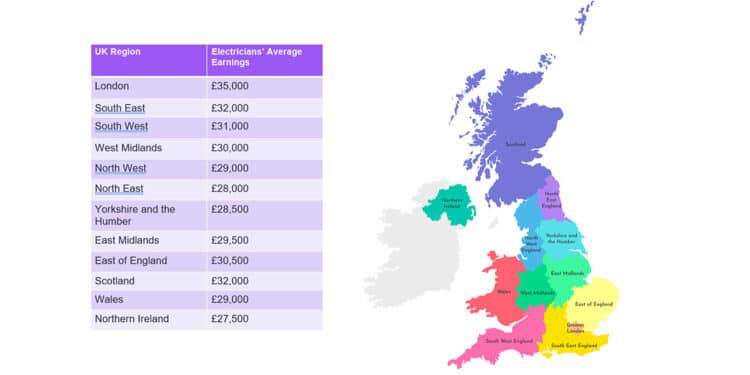

Geographic variations in earnings

Factors influencing electrician earnings

Ongoing education and certifications

To boost your career as an electrician, regularly investing in relevant courses and certifications is essential. For example, enrolling in a City & Guilds Level 3 Award in Inspection and Testing can significantly enhance your credibility. This certification not only improves your skills but also allows you to charge higher rates for specialist services. The benefit is clear: with advanced qualifications, you become more marketable and can take on more complex, higher-paying jobs, ultimately increasing your overall earnings.

Geographical Mobility

To maximise your earnings as an electrician, consider working in high-demand areas or regions with higher average wages. For instance, if you’re based in a low-demand area, explore job opportunities in London or other major cities where the demand and pay for electricians are substantially higher. By moving or commuting to areas with a shortage of skilled electricians, you can significantly boost your income and take advantage of better-paying job opportunities.

Efficient Business Operations

To streamline your operations and boost profitability, consider using business management software to manage appointments and handle invoicing. For example, implementing software like Tradify or SimPRO can help you efficiently manage quotes, schedule jobs, and track payments. This not only saves time and reduces administrative costs but also allows you to focus more on billable work, ultimately improving your overall profitability.

Quality Tools and Equipment

Investing in high-quality tools and equipment is crucial for ensuring efficiency and safety in your work. For example, purchasing reliable brands and regularly maintaining your tools can prevent downtime caused by equipment failure. The benefit of using high-quality tools is that they increase your efficiency, enabling you to complete jobs faster and take on more work, which in turn boosts your earnings.

Additional Income Opportunities

Electricians have several avenues for boosting their income beyond regular hours. Overtime and emergency callouts can significantly increase earnings, especially since these often pay at higher rates. Special projects and high-profile contracts, like wiring new commercial developments or working on large-scale industrial installations, can offer lucrative pay.

Additionally, experienced electricians can explore teaching and training roles within the industry. Conducting workshops, providing training for apprentices, or teaching at technical schools not only supplements income but also establishes them as experts in their field, opening more doors for high-paying opportunities.

Financial Management for Electricians

Budgeting and financial planning help ensure stability and growth. It’s essential to account for business expenses like tools, materials, insurance, and licensing fees, while also considering tax obligations, which can be complex. Setting aside funds for taxes and unexpected expenses can prevent financial strain.

To maximise earnings and manage income fluctuations, electricians should diversify their services, seek high-demand projects, and establish a solid customer base. Additionally, maintaining a good financial cushion and regularly reviewing and adjusting the budget can help navigate slow periods and capitalise on profitable opportunities.

Developing a financial plan is essential for managing your earnings, saving for slow periods, and investing in your business. For example, set aside a portion of your earnings each month into a savings account or invest in a pension plan for long-term security. This approach ensures financial stability, allowing you to focus on growing your business without the stress of financial uncertainties during off-peak periods.

Long-Term Earnings Potential and Career Growth

The long-term earnings potential for electricians is promising, with significant increases possible as they gain experience and build a strong reputation. As electricians advance in their careers, they can move into higher-paying roles such as a senior electrician, supervisor, or even consultant.

Career growth opportunities abound, and diversifying services—such as offering specialist installations, energy-efficient solutions, or smart home systems—can attract a broader clientele and command higher fees. Expanding business offerings to include maintenance contracts or emergency services can also ensure a steady income stream and enhance overall profitability.

Expanding your service offerings to include high-demand areas like smart home installations, renewable energy systems, or electric vehicle charging stations can significantly enhance your business. For example, taking a course on installing and maintaining solar panels or EV charging points broadens your expertise. This not only increases your client base but also opens up new revenue streams, allowing you to charge premium rates for specialist services and ultimately boosting your overall earnings.

Get Electrician Insurance with Protectivity

If you’re working for an employer, then you’ll normally be covered by whatever insurance provision they have in place. But if you’re working on a self-employed basis or running your own electrician business where you’re employing other people, then having your own cover in place is a must. If something goes wrong, the financial implications can be severe, which is why having the correct tradesman insurance is essential. You can also get tools insurance cover with us, starting at just £8.98 a month.

At Protectivity, we specialise in providing electricians insurance to professionals and entrepreneurs just like you. Our cover includes up to £5 million of public liability cover, employers’ liability if you hire other people, and the option for commercial legal protection in case you need support in this area.

Find out more about our affordable policies, excellent claims handling, and monthly payment options when you request a quote today.

*Disclaimer – This blog has been created as general information and should not be taken as advice. Make sure you have the correct level of insurance for your requirements and always review policy documentation. Information is factually accurate at the time of publishing but may have become out of date.

Last updated by