Table of contents

Table of contents

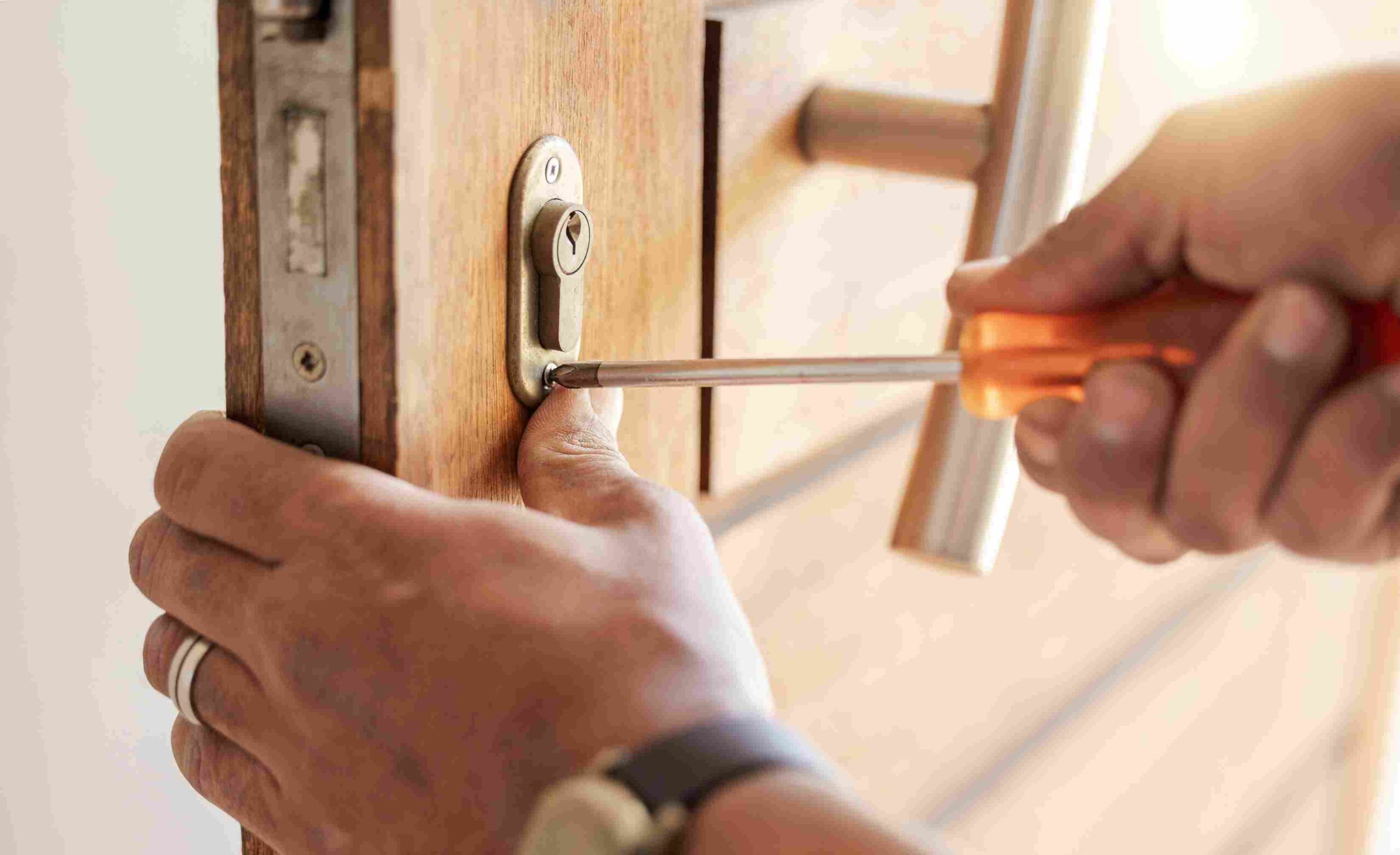

Have you ever locked yourself out of your home and wished you had the skills to save the day? Rescuing customers from these types of predicaments is a typical day in the life of a locksmith. It’s a job in demand, especially those with the skills and experience to take on large projects. Data from the Master Locksmith Association (MLA) indicates there are only just over 340 registered locksmiths in the UK. Whilst the profession is not regulated any many will not be certified it provides an indication that there is scope to develop and progress in the career.

You may well ask now – how can I become a locksmith? If you’re curious about how to join their ranks, you’ve come to the right place. Here’s some top tips you need to know about becoming a locksmith in the UK.

Why become a Locksmith?

So, why would you want to become a locksmith? For starters, it’s a flexible and rewarding career. Whether you’re a night owl who thrives on 3am emergency callouts or someone who prefers planned jobs during daylight hours, locksmithing lets you set your own schedule.

There’s also the sheer satisfaction of helping people out of sticky situations. Nothing beats the look of relief on someone’s face when you rescue them from a locked car or a jammed front door. And let’s not forget the earning potential – with the right skills and effort, locksmithing can be a lucrative career.

What does a locksmith do?

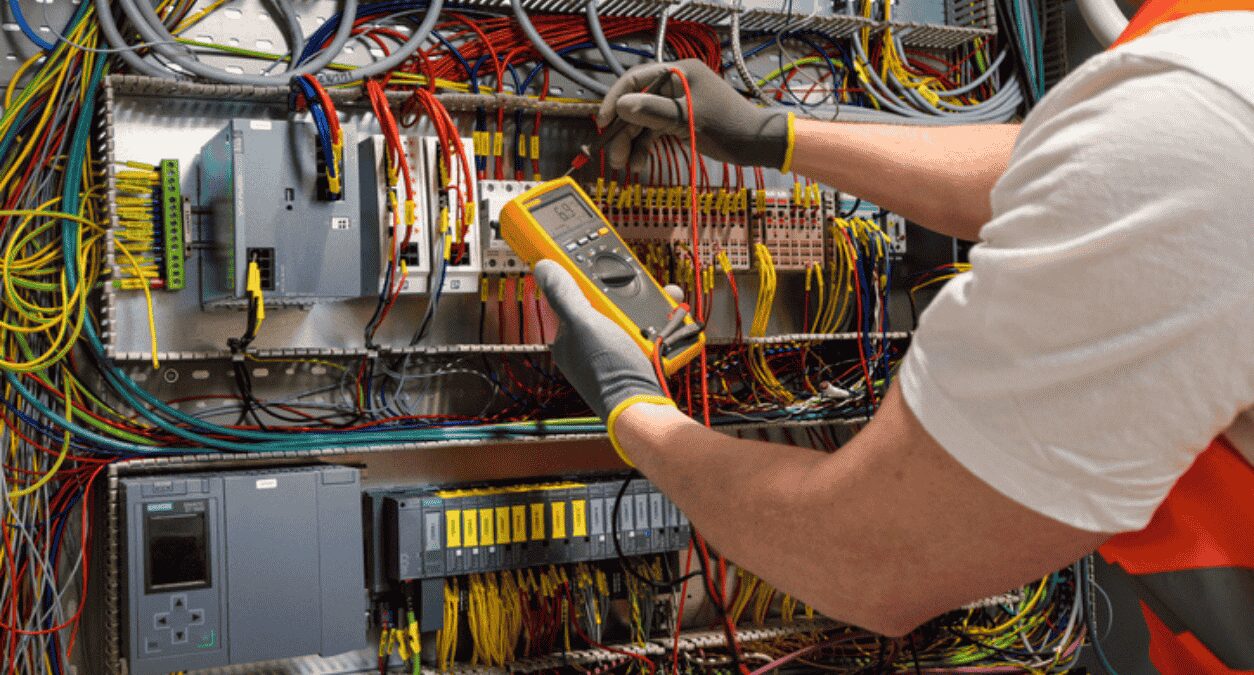

The life of a locksmith is anything but boring. One moment you’re replacing a lock for a new homeowner, the next you’re cutting keys in your workshop, and before you know it, you’re on your way to rescue a forgetful customer locked out of their car.

Locksmiths also install high-security locks, repair broken mechanisms, and even work on safes. If you’re tech-savvy, there’s a growing demand for locksmiths who can handle digital and smart locks. So, no two days are the same, and there’s always something new to learn.

Skills and qualities you’ll need

Before you throw money at training, it’s worth checking if you’ve got the right qualities for the job. A locksmith needs to have:

- Manual dexterity: You’ll be working with small parts, so steady hands are a must.

- Problem-solving skills: Every lock is a puzzle waiting to be solved.

- Patience: Some locks will test your limits – and so will some customers.

- Customer service skills: A friendly attitude goes a long way in this business.

- Reliability: Customers depend on you to show up and get the job done.

Training and Qualifications

While there’s no legal requirement for formal qualifications to become a locksmith in the UK, proper training is essential to develop the skills and knowledge needed for the job. Here’s a quick rundown of what you need to know:

Locksmith training courses

- Basic Courses: These cover essential skills like lock picking, key cutting, and repairing standard locks. Most courses last 3–5 days, making them a quick way to get started.

- Advanced Courses: For those looking to specialise, advanced training focuses on digital locks, safes, and automotive locksmithing.

- Reputable Providers: Look for accredited training centres or organisations such as the Master Locksmiths Association (MLA) to ensure high-quality instruction.

On-the-Job Experience

- Practical experience is just as important as formal training. Many locksmiths start by working with an experienced professional or practising on old locks to hone their skills.

Accreditation and memberships

- Joining the Master Locksmiths Association (MLA) is a great way to boost your credibility. It’s not mandatory, but it demonstrates professionalism and helps build trust with customers.

- A DBS (Disclosure and Barring Service) Check is also advisable, as it reassures clients that you’re trustworthy and reliable.

How long does it take to become a locksmith?

The answer depends on how far you want to take your training. Basic locksmith courses can be completed in a few days, giving you the skills to start with standard locks. If you want to specialise in areas like digital locks, safes, or automotive locksmithing, additional training is required, which could take a few weeks or months.

How much does it cost to become a locksmith?

Getting started as a locksmith doesn’t have to break the bank, but there are some upfront costs:

- Training courses: Basic courses start around £400, while advanced ones can reach £1,000 or more.

- Tools: A basic toolkit can cost £500-£1,000, depending on the quality.

- Extras: Consider insurance, marketing, and optional memberships like the MLA.

On average, you can expect to invest £2,000 to £3,000 to get your locksmith career off the ground.

How much can you earn as a locksmith?

Here’s where things get interesting. As a locksmith, your earnings depend on factors like location, experience, and whether you’re self-employed or working for a company.

On average:

- A beginner locksmith might earn £18,000-£25,000 per year.

- Experienced locksmiths can earn £30,000-£40,000.

- Self-employed locksmiths can earn significantly more, especially if they offer 24/7 emergency services.

Emergency callouts can fetch £60-£100 per job, and if you’re dealing with high-security locks, those fees can climb even higher.

Do locksmiths need a licence in the UK?

Here’s the good news – you don’t need a formal licence to become a locksmith in the UK. However, that doesn’t mean you can wing it with a screwdriver and a prayer. Customers need to trust you with their security, and that’s where qualifications, training, and a DBS (Disclosure and Barring Service) check come in handy.

Joining the Master Locksmiths Association (MLA) can also give you a stamp of credibility. While it’s not mandatory, it’s a great way to show customers you mean business.

Starting a locksmith business

So, you’ve got the skills, the tools, and the determination – now it’s time to start your locksmith business. Here’s how to get things rolling:

Register your business

First things first, you’ll need to decide whether you want to operate as a sole trader, partnership, or limited company. Each option has its pros and cons, but most locksmiths start as sole traders for simplicity. Don’t forget to register with HMRC and sort out your taxes.

Get Insured

Insurance is a must for any locksmith business. Public liability insurance for locksmiths protects you if something goes wrong on the job, and tool insurance covers your expensive kit in case of theft or damage. If you’re working on high-value locks, additional coverage might be worth considering.

Invest in tools

Your tools are your bread and butter. Make sure you’ve got a high-quality set that includes picks, tension wrenches, drills, and key cutters. As your business grows, you can invest in more specialised tools for safes, digital locks, or automotive locksmithing.

Create a pricing structure

Decide how much you’ll charge for different services. Research competitors in your area to ensure your prices are competitive but still profitable. Don’t forget to factor in emergency call-out fees for those middle-of-the-night rescues.

Market your services

No one can hire you if they don’t know you exist. Build a professional website showcasing your services, expertise, and contact details. Invest in local SEO so your business appears in “locksmith near me” searches. Don’t underestimate the power of social media, word-of-mouth referrals, and online review platforms like Trustpilot.

Offer 24/7 services

If you’re ready for the challenge, offering round-the-clock services can set you apart from competitors. Emergencies don’t stick to a 9-to-5 schedule, and being available at odd hours often commands higher fees.

Build a strong reputation

Reliability and excellent customer service are key to growing your business. Always arrive on time, complete jobs efficiently, and maintain a friendly, professional attitude. Happy customers will leave glowing reviews and recommend you to others.

Tips for Success

Like any job, locksmithing has its challenges. Emergency callouts at odd hours can be tough, and competition in some areas can be fierce. But with the right approach, you can thrive.

Here are a few tips:

- Offer 24/7 service: Customers will love your availability.

- Keep learning: Stay updated on new technologies and lock types.

- Market yourself: Build a website, use social media, and network locally.

- Be reliable: A great reputation is the key to long-term success.

Becoming a locksmith in the UK is a fantastic career choice if you’re looking for variety, independence, and the chance to help people in their hour of need. Whether you’re just starting out or looking for a career change, locksmithing offers flexibility, steady demand, and plenty of room to grow.

Get Locksmith Insurance from Protectivity

*Disclaimer – This blog has been created as general information and should not be taken as advice. Make sure you have the correct level of insurance for your requirements and always review policy documentation. Information is factually accurate at the time of publishing but may have become out of date.

Last updated by