The UK construction industry’s busier than ever — and it’s not slowing down any time soon. In fact, the CITB has estimated that over 250,000 extra workers will be needed by 2028 to keep up with demand across housing, infrastructure, and repair projects. If you’re already working in the trade or running your own business, that’s good news — but it also means the bar is being raised when it comes to skills and qualifications.

Skilled workers are in demand, and that’s reflected in pay too. According to the BCIS, construction wages have gone up by around 6.7% in the past year alone, especially for those with solid experience and recognised qualifications under their belt. That’s where the Gold CSCS card comes in. Whether you’re looking to prove your skills, take on more responsibility, or just boost your earning potential, having a Gold card shows you’re serious about your trade.

In this guide, we’ll cover everything you need to know: what the Gold CSCS card is, who it’s for, what qualifications you need, how to apply, and how it compares to the other card types out there. Whether you’re a seasoned pro or looking to level up, it’s all here.

What is a Gold CSCS card?

The Gold CSCS card is a recognition of your skills, qualifications, and experience within the construction industry. It’s not just a flashy card with a nice colour – it tells employers and site managers that you know your trade inside out.

There are two types of Gold CSCS cards:

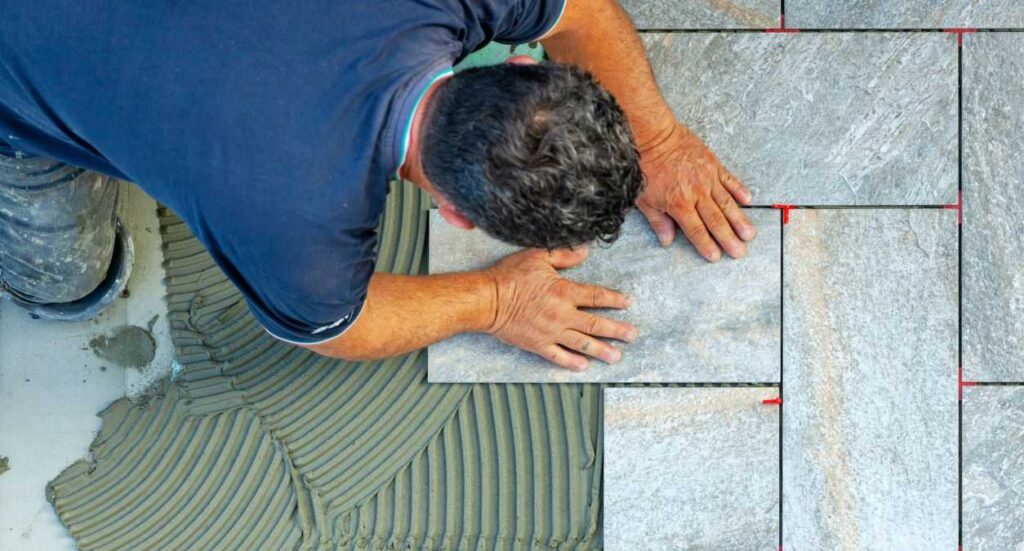

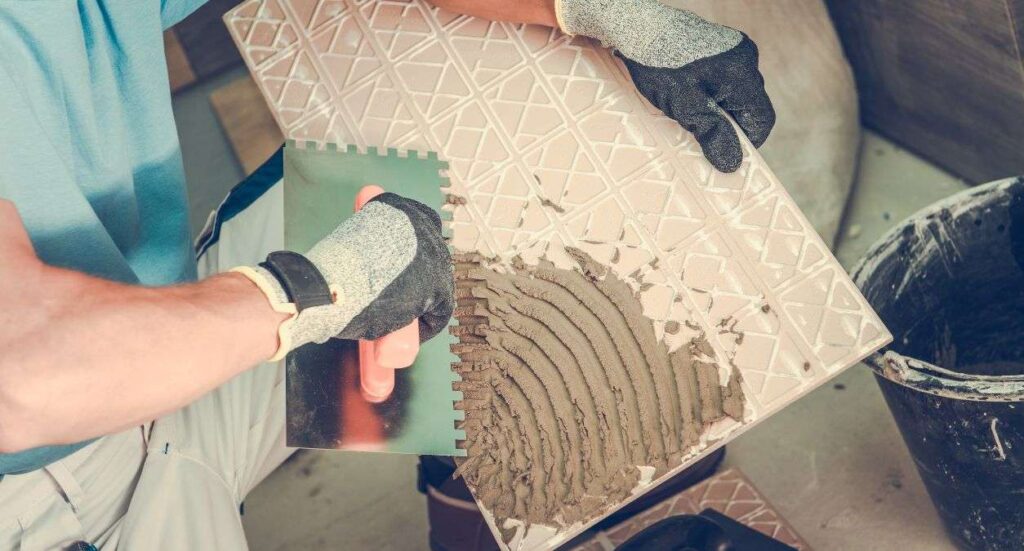

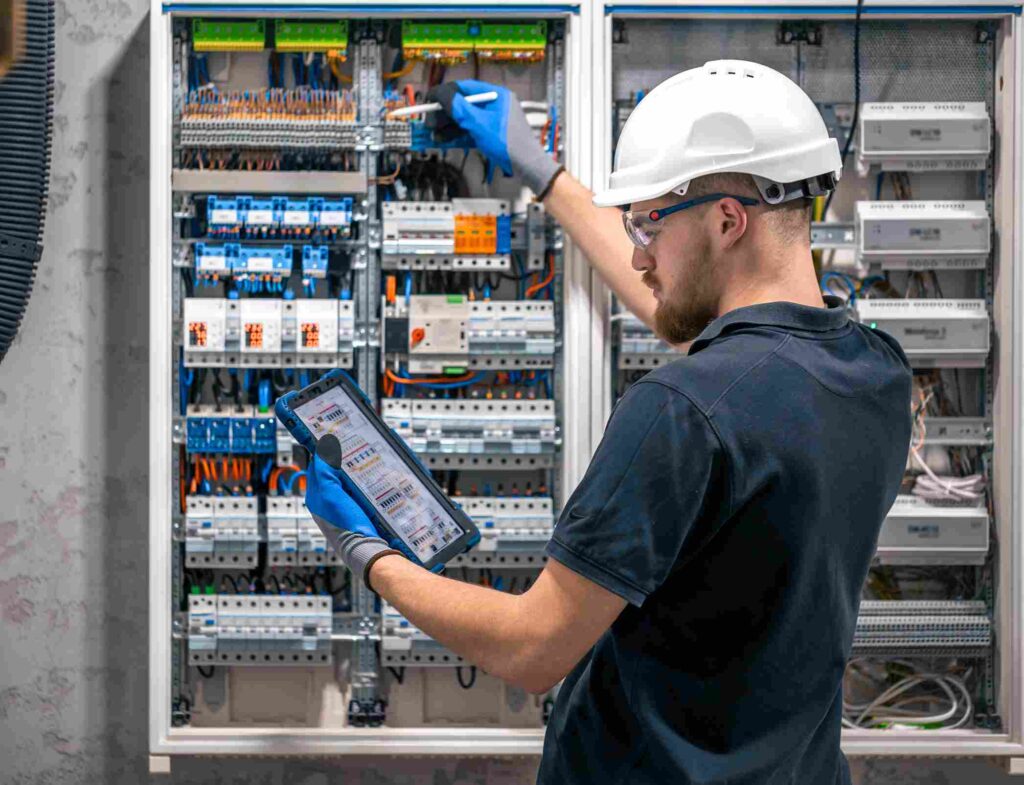

- Gold Skilled Worker Card – for experienced tradespeople who have completed a Level 3 NVQ or equivalent in their specific trade.

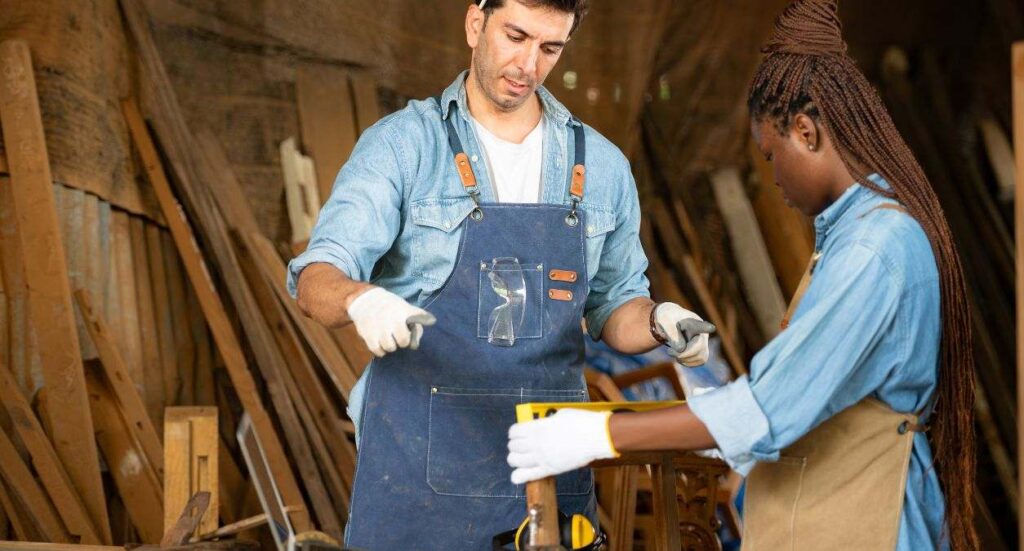

- Gold Supervisor Card – for those in a supervisory or foreperson role, often with additional responsibilities like overseeing other workers on-site.

Think of the Gold card as a badge of professionalism. It shows you’re not only capable but certified to work safely and competently.

Why do you need a Gold CSCS card?

Holding a Gold CSCS card isn’t just a box-ticking exercise – it’s a powerful way to show that you’re a skilled professional who takes their trade seriously. From getting through the site gates to landing better jobs and meeting health and safety requirements, a Gold card can open doors and boost your reputation across the construction industry. Here’s why having one really matters:

- Site access – Most major construction sites in the UK now require a valid CSCS card. Without one, you might not even make it past the car park.

- Proof of skill – It proves you’re properly qualified and experienced, which builds trust with employers and clients.

- Better job opportunities – Many higher-paying roles or supervisory positions require a Gold card as standard.

- Health & Safety – It shows you’ve passed the relevant Health, Safety & Environment (HS&E) test, which is a key part of keeping everyone on-site safe.

Requirements for a Gold CSCS card

Following requirements is about showing that you’ve gained solid experience on-site, completed the right training, and earned formal, industry-recognised qualifications. Whether you’re applying as a skilled tradesperson or stepping up to a supervisory role, you’ll need to prove your knowledge, capability, and commitment to high standards. Let’s break it down by card type:

For the Skilled Worker Card:

- A Level 3 NVQ/SVQ in your trade (e.g., carpentry, plumbing, electrical installation).

- Pass the CITB Health, Safety & Environment (HS&E) test for Operatives within the last 2 years.

For the Supervisor Card:

- A Level 3 or 4 NVQ/SVQ in Occupational Work Supervision or a relevant supervisory qualification.

- Pass the CITB Supervisor-level HS&E test (not the basic Operatives version).

How to apply for a Gold CSCS card

These are the main steps to follow, to ensure you get your card:

- Get Your Qualification – Make sure you have the right NVQ or SVQ. If you don’t, you can look into on-site assessment routes or training providers that offer recognised qualifications.

- Pass the HS&E Test – Book your test via the CITB website. Choose the Operative or Supervisor test depending on your card type.

- Apply Online – Head over to the official CSCS website to apply. You’ll need to upload proof of your qualification and test pass.

- Pay the Fee – The application currently costs £36 (as of 2024).

- Wait for Delivery – Your card should arrive within a couple of weeks, but you can use your application confirmation as proof while you wait.

Other steps and tips getting a CSCS card

- Finding an NVQ Provider – Make sure your training provider is accredited. Some providers even assess you on-site while you work.

- Upgrading from a Blue Card – If you already have a Blue Skilled Worker card, upgrading to Gold can be a natural next step once you complete a Level 3 NVQ.

- Renewals – The Gold card is valid for 5 years. You’ll need to retake the HS&E test and provide evidence of continued competence to renew.

- Lost or Damaged Card? – You can order a replacement easily through the CSCS website.

Gold CSCS vs other cards

To put things in perspective:

- Green Card – Labourer (entry-level)

- Blue Card – Skilled Worker (Level 2 NVQ)

- Gold Card – Advanced Skilled Worker or Supervisor (Level 3+)

- Black Card – Manager (Level 5+ in site or project management)

So, if you’re already working at a high level in your trade, or managing others on-site, Gold is the card you should be aiming for.

Read more about the process from the start in our blog on How to get a CSCS card.

CSCS Gold card FAQs

Can I get a Gold card without an NVQ?

Generally, no. But there are experienced worker routes where you can gain an NVQ through on-site assessment.

How long does the whole process take?

If you already have your qualification and HS&E test completed, the card can be with you in as little as 10 working days.

What if my qualifications are from outside the UK?

Some overseas qualifications can be accepted. You may need to go through a UK NARIC (now Ecctis) check or get UK-equivalent certification.

To sum up

Getting your Gold CSCS card is a smart investment in your future. It opens doors to better jobs, more responsibility, and higher pay. Plus, it proves to clients, employers, and site managers that you’re the real deal.

Whether you’re moving up from a blue card or aiming to step into a supervisory role, the Gold card shows you’re serious about your trade.

If you’ve got any questions or want help with the application process, drop a comment or reach out. And if you’re running a small business, getting your team qualified to gold level can really boost your reputation and win more contracts.

Get Specialist Tradesman Insurance from Protectivity

Health and safety is an unavoidable element of the construction industry, which is why having the right tradesman liability insurance is so important. With the everyday risks of site work, like accidents, property damage, or third-party injuries – a solid insurance policy offers essential financial protection. Many clients will also want to see proof of cover before signing a contract, so being insured helps you work professionally and with confidence.

At Protectivity, we offer affordable tradesman insurance tailored to the needs of those in the trade. Our standard policies include up to £5 million public liability cover, with optional add-ons like Employers’ Liability, Contractor Works, Plant and Tools, and more. That way, if the unexpected happens, you’re covered where it counts.

Whether you’re a builder, bricklayer, or other trades we have specific Contractors All Risk cover to suit you. Find out more when you get a quote here.

Get Tradesman Insurance from Protectivity

*Disclaimer – This blog has been created as general information and should not be taken as advice. Make sure you have the correct level of insurance for your requirements and always review policy documentation. Information is factually accurate at the time of publishing but may have become out of date.

Last updated by