Table of contents

The West Midlands and the City of Bristol have been named as two of Britain’s best places to become a personal trainer.

The number of personal trainers in Britain is growing, and according to Ibisworld, there are now over 23,000 registered PTs in the UK, but the local spread of these trainers, and the demand for their help, varies massively.

Our recent research shows that the two regions have some of the highest demand for fitness professionals in the country, but lack the competition of a large number of other PTs.

Figures show that in approximately one in 180 of Bristol’s residents will perform a Google search, looking for a personal trainer each year. This figure is usurped only by Greater London, where one in 135 people will seek out the help of a fitness pro in a 12 month period.

However, while the capital’s county is home to nearly 4,000 personal trainers, Bristol is only the 43rd most PT populous of the 106 counties and regions researched.

The West Midlands meanwhile has fewer personal trainers per capita than all but six English counties. Therefore anyone looking to become a personal trainer in Birmingham, Coventry or Wolverhampton and take advantage of the 1,000 people in the region looking for a PT each month, won’t have a huge amount of competition to contend with.

Where’s best to find a PT?

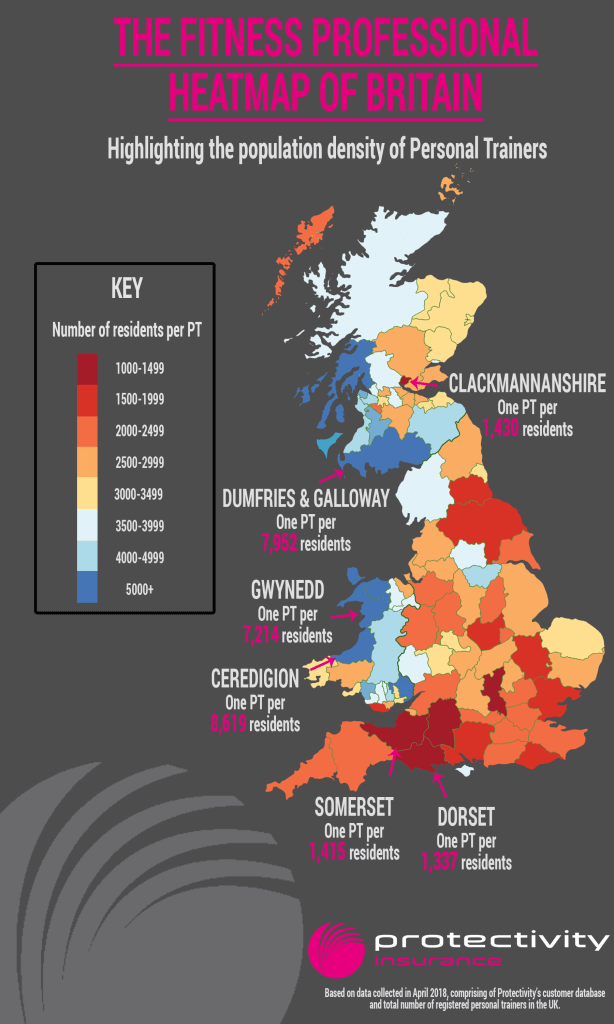

The highest build-up of fitness professionals is generally clustered towards the south-west of England, with Dorset and Somerset home to the highest population of PTs relative to total residents.

With over 300 personal trainers shared between it’s population of 422,900, Dorset boasts an impressive one personal trainer to every 1,337 residents.

However, not only is it already home to a large number of personal trainers, according to Google searches there isn’t much of a demand for their services, relatively speaking. The county came 99th of 106 regions in terms of number of searches each month, potentially making it one of the most tricky places to start a personal training career.

Another area that doesn’t appear to be on the look out for PT tutelage is Nottinghamshire. With a similar number of searches a month per head to Dorset, it’s worth noting that the county is the 15th most densely populated region of Britain for fitness professionals.

For those looking to start a career in the leisure industry in Wales, there’s some good news and some bad news. Seven of the 23 council areas sit in the bottom 10 when it comes to the areas that Britain’s PTs call home.

That being said, the search volume for personal trainers in the country sits in mid-table of our research, meaning while the competition may not be there, it may be that neither is the demand.

Market analysis is key

When considering a career in the fitness industry it’s wise to think about whether there is a) a demand for more fitness professionals in your area and b) room for another competitior on the market.

By looking at the number of Google searches and number of personal trainers already operating in your region, potential PTs can get a good idea whether this is the right career move for them. Of course, if you have a niche or are offering something that allows you to stand out ahead of the crowd, you could disprove the statistics.

By nailing your business plan and marketing your business wisely, life as a PT can be rewarding and a wise career move. It may not be for everyone, but by our numbers, fitness lovers in Bristol and the West Midlands, could be in the perfect spot to become a personal trainer.

*Disclaimer – This blog has been created as general information and should not be taken as advice. Make sure you have the correct level of insurance for your requirements and always review policy documentation. Information is factually accurate at the time of publishing but may have become out of date.

Last updated by